Phone

Nvidia’s Meteoric Rise: AI Boom Propels Tech Giant to Unprecedented Heights

San Francisco, CA — Nvidia, the semiconductor titan at the heart of the artificial intelligence revolution, has solidified its position as a Wall Street darling, outpacing industry expectations and reshaping the future of computing. Over the past year, the company’s market value surged by $2.5 trillion, propelling it past Apple as the world’s most valuable tech firm.

Driven by soaring demand for AI-enabled technology, Nvidia’s latest financial results highlight its dominance. The company reported a 94% increase in revenue and a staggering 106% growth in net income for the quarter ending in October. Nvidia’s ability to forecast a 70% revenue jump for the current quarter, fueled by its cutting-edge Blackwell AI chip, underscores its pivotal role in a rapidly evolving tech landscape.

Sustained Growth Amid Challenges

In the last quarter, Nvidia generated $35.08 billion in revenue, far surpassing its $32.5 billion projection. Net income also soared to $19.04 billion, outstripping tech giants like Amazon and Meta. Despite these achievements, shares dipped slightly in after-hours trading due to supply constraints of its latest chips.

Colette Kress, Nvidia’s Chief Financial Officer, acknowledged the bottleneck but assured investors that additional supply channels would alleviate shortages by early next year.

“Challenge is scaling up production to meet demand,” Kress said. “We’re working with suppliers to overcome the constraints.”

Dominance in AI Infrastructure

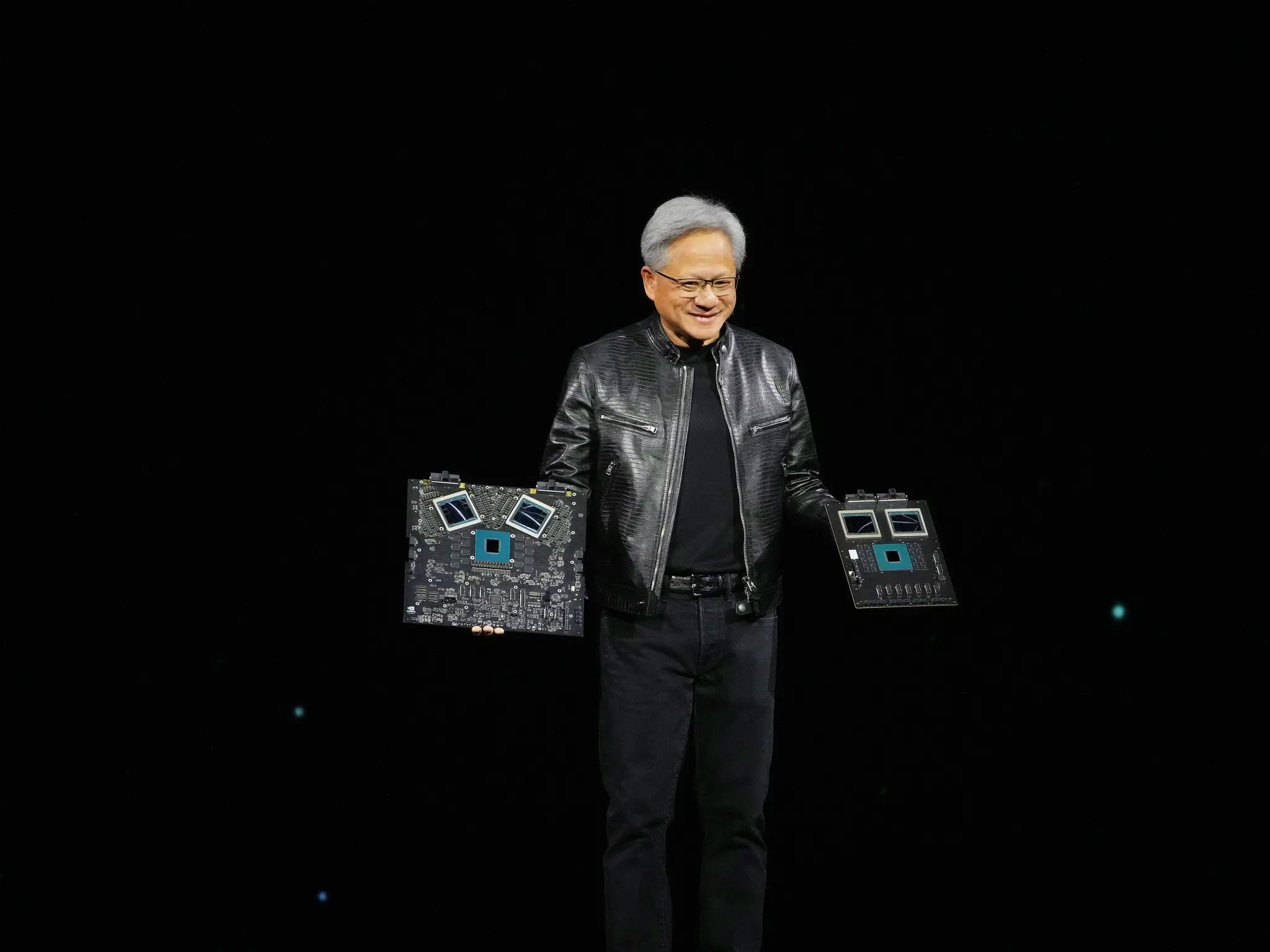

Nvidia’s GPUs have become a cornerstone of the AI boom, powering applications ranging from chatbots to drug discovery. The company’s dominance is rooted in CEO Jensen Huang’s long-term vision to position GPUs as essential for training AI models. Huang, now a prominent voice in AI, has likened the technological shift to the Industrial Revolution.

“The computer industry has fundamentally transformed,” Huang said. “We are no longer just creating software but manufacturing intelligence.”

This vision has led Nvidia to control 90% of the AI chip market, further cementing its status as a bellwether for industry.

Blackwell Era

the recent release of Nvidia’s Blackwell chip marks a new chapter in AI computing. GB200 NVL72, the most powerful iteration, features advanced water-cooling systems and is designed for next-generation data centers. However, the product’s complexity has introduced hurdles, including adjustments to manufacturing processes and new installation requirements for customers.

David Ruderman, portfolio manager at Endurance Capital Partners, highlighted the high stakes involved.

“We’re betting on a significant inflection point in AI computing,” Readerman said. “Blackwell is key to that future, but its complexity reflects the scale of this transformation.”

Regulatory Scrutiny and Future Prospects

As Nvidia scales new heights, it faces regulatory inquiries into its sales practices from authorities in the United States, Europe, and Asia. The company has pledged full cooperation but has yet to disclose potential implications.

Looking ahead, Nvidia is committed to annual updates of its GPU lineup, with plans to release a Blackwell successor in 2026. Despite geopolitical uncertainties, including potential tariffs under a renewed Trump administration, Nvidia remains optimistic about sustained growth.

“We expect this modernization and creation of a new industry to continue for several years,” Huang said, emphasizing the transformative potential of AI.

Road Ahead

Nvidia’s rapid ascent underscores the monumental impact of AI technology on global markets and industries. While challenges remain—from supply chain constraints to regulatory pressures— the company’s innovative strides in AI infrastructure position it as a leader in shaping the future of computing.

As AI becomes an integral part of daily life, Nvidia’s role in this revolution appears destined to expand, reinforcing its status as a tech powerhouse in a new era of intelligent systems.

- Nvidia Doubles Profit as A.I. Chip Sales Soar The New York Times

- Nvidia earnings forecast top expectations as ‘age of AI is in full steam’ Yahoo Finance.

- NVIDIA Announces Financial Results for Third Quarter Fiscal 2025 NVIDIA Blog