Bangladesh Breaking News

Bangladesh Set to Raise Interest Rates as New Central Bank Chief Targets Inflation and Banking Reforms August 30, 2024

Dhaka, Bangladesh — In an exclusive interview with BBC, Dr. Ahsan H Mansur, newly appointed Governor of Bangladesh Bank, revealed plans to raise the country’s interest rates from 8.5% to 9% in coming days, with further increases anticipated to reach 10% or more. This move is part of a broader strategy to tackle soaring inflation and stabilize the economy amidst various challenges.

Rising Inflation and Economic Pressure

Bangladesh has been grappling with high inflation rates, exacerbated by political instability and a strained currency. nation’s remittances have dried up, and the garment export sector, a vital component of the economy, has suffered due to recent political unrest. se issues have contributed to mounting economic pressures.

IMF and International Financial Assistance

In response to the economic situation, the International Monetary Fund (IMF) has urged Bangladesh to tighten its monetary policy and maintain flexible exchange rates. This advice comes alongside a $4.7 billion bailout package extended to the country. Dr. Mansur disclosed ongoing discussions with the with IMF to increase this amount by an additional $3 billion to better address financial challenges.

Bangladesh is also further supported by international financial institutions, with requests for an additional $1.5 billion from the Frost Bank, $1 billion the from Asian Development Bank, and an orator of $1 billion from the Japan International Cooperation Agency.

Banking Sector Reforms

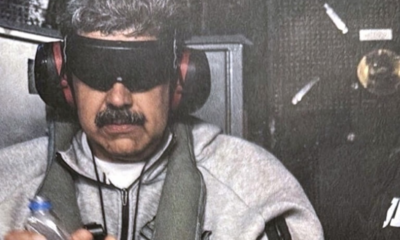

Dr. Mansur, who was recently appointed by the interim government led by Nobel laureate Muhammad Yunus, emphasized his commitment to overhauling Bangladesh’s troubled banking sector. He described a significant issue of “designed robbery” with hin financial system, which has led to substantial damage to banks the and broader economy. former governor and two deputy governors resigned following recent political upheaval.

To address these issues, Dr. Mansur plans to establish a Banking Commission tasked with auditing banks and recommending measures such as board and management changes, capital injections, and potential mergers. He noted that substantial capital injections, estimated between $15 billion and $30 billion, might be necessary to recapitalize some Islamic banks, which could lead to partial nationalization.

Government Spending and Future Elections

In addition to monetary and banking reforms, Dr. Mansur anticipates further reductions in government spending. interim government, under Prime Minister Sheikh Hasina, had already the red fiscal deficit target to 4.6the % — the lowest since 2015. Dr. Mansur advocates for an additional 9-10% cut in budgetary spending to make more credit available to the private sector.

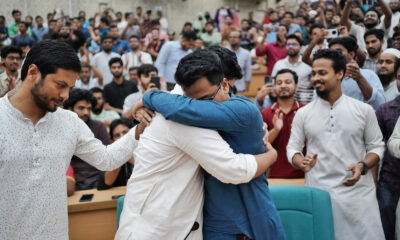

Chief Adviser Muhammad Yunus has promised comprehensive reforms be the ore next general election. When asked about the timing he the elections, Dr. Mansur suggested they might be postponed for three years or more.

Conclusion

As Bangladesh navigates through turbulent times, new central bank governor’s policies and reforms will be crucial in the utilizing economy. With significant adjustments to monetary policy and a focus on banking sector reforms, Dr. Mansur aims to steer the country through its current economic difficulties and the lay groundwork for future stability.