Business

Nvidia’s Market Thrills: From AI Boom to Stock Volatility and Future Prospects

Nvidia’s journey over the past two years has been nothing short of a financial roller coaster. As the primary beneficiary of the artificial intelligence (AI) surge, Nvidia saw its market capitalization skyrocket nearly ninefold since late 2022. This meteoric rise, which saw the company briefly become the world’s most valuable public entity in June, has recently given way to significant turbulence. In the wake of its peak, Nvidia experienced a dramatic 30% decline in value over seven weeks, translating to a staggering loss of around $800 billion in market cap.

Yet, the chipmaker is on a path to recovery. Nvidia’s stock is trading within 6% of its all-time high, driven by a recent rally. As the company prepares to report its quarterly results on Wednesday, Wall Street keenly focuses on the potential for continued volatility. stakes are high: any sign of waning AI demand or spending cuts from major cloud clients could result in substantial revenue slippage.

“It’s the most important stock in the world right now,” says Eric Jackson of EMJ Capital. “If y lay an egg, it would be a major problem for the whole market. I think you’re going to surprise to the upside.”

Nvidia’s prominence has been recurring in recent earnings calls from tech giants like Microsoft, Alphabet, Meta, Amazon, and Tesla. se companies are major consumers of Nvidia’s graphics processing units (GPUs), which are critical for AI model training and massive data processing tasks.

market’s enthusiasm for AI remains strong, though some experts believe its impact is still underappreciated. Nvidia’s revenue has surged more than threefold annually in the last three quarters, primarily due to its data center business. Analysts are forecasting a fourth consecutive quarter of triple-digit growth, albeit at a slightly moderated pace of 112%, reaching $28.7 billion. forecast for the October quarter is equally pivotal, with expectations of about 75% growth to $31.7 billion. Positive guidance would indicate robust ongoing investment in AI infrastructure, while a disappointing outlook could signal a slowdown in spending.

Despite its impressive profit margins, Nvidia faces ongoing questions about long-term return on investment for its clients, who invest heavily in its high-cost devices. company’s CFO, Colette Kress, has previously indicated that cloud providers generating $5 in revenue for every $1 spent on Nvidia chips over four years could bolster investor confidence. Analysts anticipate more data on return on investment metrics in upcoming reports to reinforce this outlook.

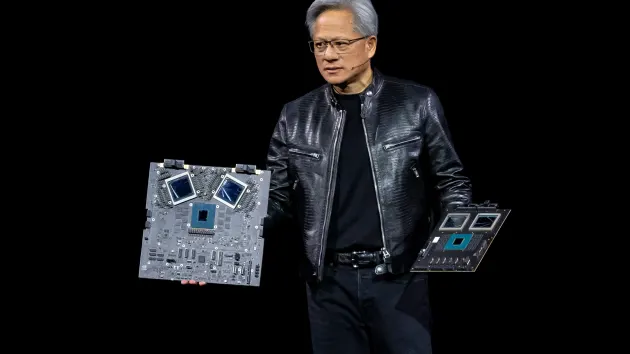

Another critical aspect of Nvidia’s future is its next-generation AI chips, known as Blackwell. Reports have surfaced about potential production delays, which could push significant shipments into early 2025. While the company’s current Hopper chips, particularly H200, are still in high demand, delays in Blackwell might simply shift future revenue rather than diminish it.

Nvidia’s performance remains a barometer for the broader tech market, reflecting the health and direction of AI investment. As investors await the company’s quarterly results, the focus will be on whether Nvidia can sustain its growth trajectory amid evolving market dynamics.