card

The American Express Auto Purchasing Program

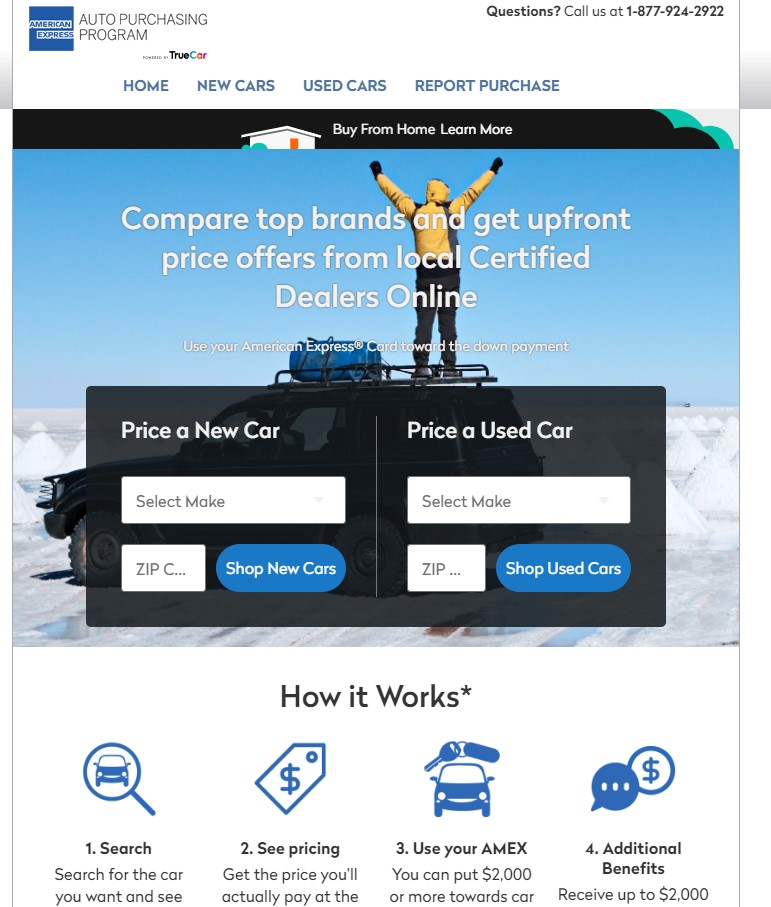

American Express has a TrueCar portal that can help customers purchase cars with their AMEX Credit Card .

If you’re planning to make use of the American Express card to purchase cars, Amex’s Auto Purchasing Program could be the right choice. The majority of dealers that are affiliated with this program will allow the purchase of at least $2,000 to an Amex card. Some dealers will let you pay for the entire cost of the purchase. This is what you should be aware of about the Amex Auto Purchasing Program.

Picture this: You’re in the market for a new car. You’ve spent hours online, comparing models and features, dreading the looming dealership negotiation. That’s where the American Express Auto Purchasing Program comes in, like a personal shopper for your next vehicle.

What the Heck is This Program?

In a nutshell, the American Express Auto Purchasing Program is a partnership between Amex and TrueCar. It’s designed to streamline car buying for Amex cardholders, taking some of the guesswork and awkward haggling out of the equation. Think of it as your ace in the hole when it comes to finding the right car at a fair price.

Okay, But How Does It Work?

- Build Your Dream Machine: Visit the Amex Auto Purchasing Program site. Like a digital car builder, you customize your perfect vehicle – make, model, trim, even those fancy extras.

- Price Check Reality: TrueCar provides real-time pricing data based on recent sales in your area. You’ll see what others actually paid for similar cars, giving you an informed starting point for negotiations.

- Dealership Match-Up: The program connects you with Amex certified dealers committed to transparent pricing and accepting Amex for a substantial chunk of the purchase price (minimum $2,000).

How Does the AMEX Car Buying Program Work?

Think of this program as a hybrid car-buying experience. Here’s the gist:

- The Search: Through the Amex Auto Purchasing Program, you browse for cars online, input your preferences, and get matched with certified dealers.

- The Pricing: You’ll see upfront pricing information and how much others have paid for similar vehicles. This gives you some negotiating power.

- The Purchase: You can put at least $2,000 of the car’s cost on your Amex card (some dealers may let you finance the whole thing!), earning those sweet Membership Rewards points.

Is it Worth the Hype? A Professor’s Pros and Cons

The Good Stuff

- Haggle-Free Havens: I once spent hours at a dealership feeling like I was in a bad poker game. This program aims for a less adversarial experience.

- Knowledge is Power: Seeing what others paid arms you with actual data, a weapon against those “one-time only” deals.

- Amex Perks: Using your Amex could rack up serious reward points, especially on a big-ticket item like a car.

Potential Pitfalls

- Limited Dealer Network: Your options might be more limited compared to just shopping around.

- Inventory Woes: In a tight car market, finding your exact desired vehicle can still be a challenge.

- It’s a Tool, Not a Miracle: It won’t magically get you rock-bottom prices if demand is high or your desired car is rare.

My Real-Life Student Success Story

One of my students, Sarah, was terrified of buying her first car. She used the Amex program, secured a pre-approved loan through her credit union, and walked into the dealership feeling empowered. She ended up with a great deal and even earned enough Amex points for a free weekend getaway!

The Bottom Line

The American Express Auto Purchasing Program can be a smart weapon in your car-buying arsenal, especially if you value transparency and dread the negotiation tango. However, just like any financial tool, it works best when coupled with research and realistic expectations.

The Pros and Cons of Amex’s Auto Purchasing Program

- ” The process of paying for big purchases with credit cards will earn you lots of points.

- Then” You can use the points to buy anything.-“

- Through the American Express Auto Purchases program You can save up to $3,272 off of the MSRP. But, it is important to know that there are limitations that apply to this program. For instance, the deal is only available within your state and the car must be classified as a qualifying vehicle. In addition, the dealer should not offer incentives or rebates currently being offered.

- –” To enroll in the program, you must provide proof of income.”

Cardholders can make use of this American Express car-buying service to locate their next car the dealership that allows the use of Amex to cover all or a part of the purchase

The Amex Auto Purchasing Program is an online portal that is powered by TrueCar

-You can get a great deal on a car by using the Amex Auto Purchases Program. There are three main reasons you should use the program: Compare prices from other dealerships. Get a Guaranteed Savings Certificate. Find dealers that will take Amex cards for the purchase. Obviously there are many different ways to compare car prices and make sure you pay a fair price. But TrueCar says that about one in three customers use TrueCar at some time during the car buying process. The Guaranteed Savings certificate helps you know exactly how much you’ll save on the car you’ve chosen. And if you’re looking for the right place to buy a car, the Amex Auto Purchase Program will help you find one.

When Not to Use the Amex Auto Purchasing Program

So, Should You Use It?

Like most financial choices, it depends! If you’re an Amex cardholder, a savvy negotiator, and value hassle-free research, this program could be a useful tool. Just remember, it’s not a substitute for doing your homework and being prepared to walk away from a bad deal.

Think of the American Express Auto Purchasing Program as a power-up in your car-buying arsenal, not a magic wand.

When to Skip the AMEX Program

Alright, class, let’s be honest. The Amex Auto Purchasing Program can be useful in certain scenarios, but sometimes it’s just not the best tool in your negotiation toolbox. Here’s when to reconsider:

The “I Got This” Negotiator: If you’re a natural-born haggler with a knack for sniffing out the best price, you probably don’t need the program’s training wheels. Confidently going directly to the dealer might land you a sweeter deal.

The Cash is King Situation: You’ve been saving diligently, and you’re ready to pay for your car outright. While charging the whole purchase to your Amex card sounds appealing for points, skipping the middleman (the Auto Purchasing Program) is your best bet.

The Search for Flexibility: Truth is, finding a dealer willing to take a sizable down payment of $2,000-$5,000 directly on your card isn’t always a given. If you need that flexibility, cutting out the Amex program might be less hassle.

Professor’s Real-Life Fail: Let me share a cringey story. A few years ago, I got excited about the Amex program thinking I’d be smooth and clever. Turns out, none of the dealers within a reasonable distance would take a big chunk on my card. Ended up negotiating the traditional way and feeling slightly foolish!

Bottom Line: The American Express Auto Purchasing Program is a tool, not a financial magic wand. Be smart, know your strengths as a buyer, and don’t be afraid to walk away from a deal that doesn’t serve you, program or no program.

There are a variety of reasons people make use of Amex Auto Purchases Program. Amex Auto Purchases Program. The majority of them relate to receiving the guaranteed savings certificate which can provide you with reasonable rates, especially if aren’t a pro at bargaining. It is also possible to locate an agent who will let you make the majority or even all of a purchase using your credit card or credit card. Additionally, registering into the Auto Purchaser program of Amex is completely free. After examining this program I think the majority of customers will be able to make better decisions themselves by engaging directly with dealers. It’s a bit disappointing that the Amex Auto Purchasers Program does not provide any dealers listed as accepting the $2000-$5000 down payment for a credit card although this feature may appear to be available within the next few months. If you’ve got enough cash in savings to cover the whole purchase, being able to charge the entire amount to your credit card is probably the most appealing feature that comes with this Amex Auto Purchasser Program. However, unless you manage to come across a dealer who’s willing to take a 2 000 to $5,000 deposit for an automobile, it would likely be best to negotiate with the dealer directly. For all that you can find a dealer that will take an amount of $2,000 to $5,000 for a deposit on your vehicle shouldn’t be difficult. If you’re an excellent negotiator, then you may be able to get a better deal than the Amex Auto Purchassing Program can offer.

It is the American Express Auto Purchasing Program provides a means that allows Amex cardholders to purchase used or brand new cars with competitive prices and the option of paying for your car partially using your Amex.

The accumulation of reward points can be the potential benefit. But, you might be able negotiate better prices on a wider range of automobiles by yourself. We’ll guide you through the advantages and disadvantages for using the American Express Auto Purchasing Program.

Who Can buy a car Via Credit Card

.A major factor to consider when purchasing cars with credit is the credit limit. If you do not have a credit card with a large credit limit, if the credit limits are small to purchase a car You can consider taking steps to establish a credit score and then increase it in time.

This American Express Auto Purchasing Program allows Card Members to connect with more than 10,000 American Express accepting dealers. All Certified Dealers that are part of the website will accept an American Express Card for at minimum $2,000 or the total purchase cost. You can customize your car look up a list of certified dealers that are in your region and then purchase your vehicle now!

If you have any questions regarding this program, please call 1-877-924-2922. American Express Auto Purchasing Program you can call 1-800-877-924-2222.

If you have any questions about the use of your American Express Card, please contact 1-800-528-4800..

TrueCar, Inc. (“TrueCar”) runs this website for information (“Service”) that provides prices performance, technical and safety data for both used and new vehicles. When you access the Service you are agreeing to the Terms and Conditions of Service. The cheapest price available is not guaranteed and the Service might not be available in all regions.

The Service neither TrueCar neither American Express brokers, sells or leases motor vehicles. If not stated otherwise the cars displayed through the Service are for sale by certified motor dealer. Each Certified Dealer determines its own price and the actual purchase price is determined by both you and your dealer. The vehicles displayed on this Service may be subject to prior sales. The Certified Dealer will confirm actual availability of vehicles from stock including color, options and other selections.

American Express does not make any warranties with respect to the purchase of a vehicle. The fulfillment of the benefits that come to these Service will be the responsibility solely for TrueCar and the participating dealers. In the event of allowing you to make use of the benefits of your American Express Card for at least $2,000 in your purchase cost is solely the responsibility of the Certified Dealer. Limitations on credit apply.