American Express is one of the most popular credit card companies in the United States. It offers a variety of cards, including the American Express Gold Card. The Gold Card has a number of pros and cons that consumers should consider before applying.

The American Express Gold Card is one of the most popular credit cards on the market. It has a high annual fee, but it comes with a lot of benefits. Here are some of the pros and cons of this card.

The American Express Gold Card is an excellent credit card for anyone who shops often, dines out frequently and spends money on their everyday purchases. . If you’re looking for an American Express card that will earn points with every purchase, the Gold Card is worth considering. Unlike some other cards, this one offers bonuses when you spend at restaurants and U.S supermarkets.

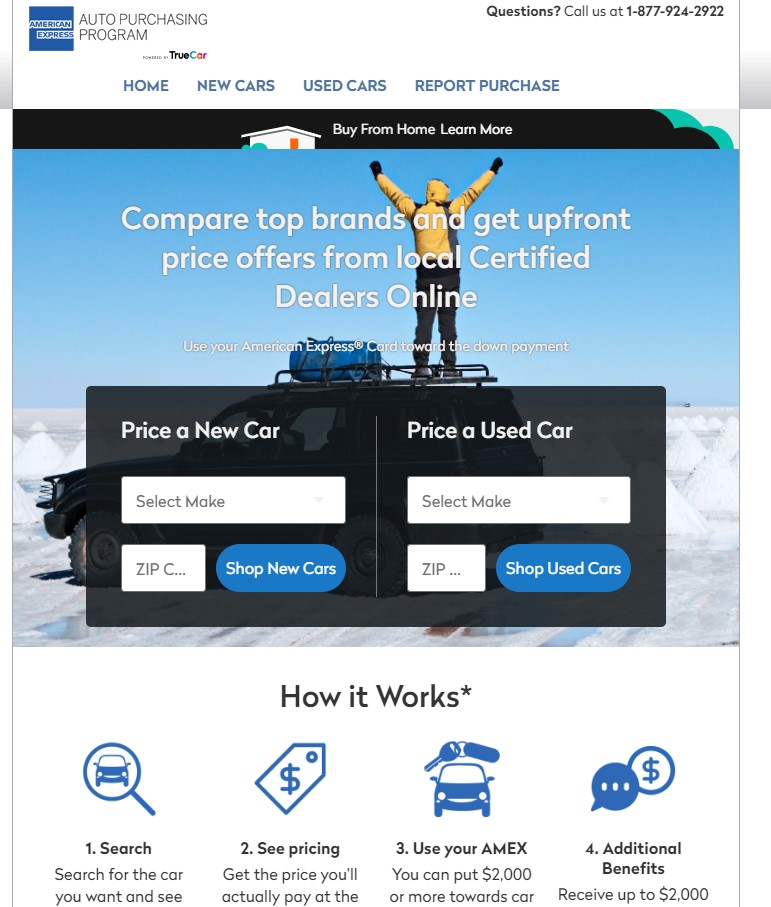

Does American Express offer auto loans?

American Express does offer personal loans, which can be used for the purchase of a vehicle. However, the program does not offer auto loans directly.

However, it’s worth noting that Amex Card personal loans may come with higher interest rates than auto loans, which are specifically designed for car purchases.

AMEX Auto Purchasing Program VS Auto Loan

The American Express Auto Purchasing Program and auto loans are two different things.

The American Express Auto Purchasing Program is a service offered by American Express to help its card members buy new or used cars at a discounted price. The program offers access to pre-negotiated prices but it does not offer to finance for the purchase.

An auto loan, on the other hand, is a type of financing that can help you purchase a car. Auto loans are typically offered by banks, credit unions, and other financial institutions, and they provide you with the money you need to purchase a vehicle. The lender will then require you to pay back the loan with interest over a period of time, typically in monthly instalments.

So, while the American Express Auto Purchasing Program can help you save money on the purchase of a vehicle, it does not provide financing for the purchase.

Pros and Cons of American Express Gold Card

| Cons of AMEX Gold Card | Pros of Amex Gold Card |

|---|---|

| Annual fee that is high $250 | Amount of $120 in dining credits each year ($10 per month) |

| Options for financing are not as flexible. | Potential for high-reward earnings |

| Categories of rewards with narrow limits | Transfer of points to a variety of partners |

| Requires good/excellent credit | Up five authorized users to no annual fees. |

| There are no lounge facilities at the airport. | The rewards program is strong with 4X points earned from dining out as well as 3X reward points when booking flights directly through airlines or amextravel.com |

| There are limited options for carrying the balance | No foreign transaction fee |

| High APR for pay-over time feature | A lot of travel credits and other perks |

| Pay over time penalty for high pay APR | Insurance for baggage will cover up to $1250 for carry-on bags and $500 for baggage checked that is lost, damaged or stolen. |

American Express Gold Card official website

Amex is among the few card networks that provide exclusive discounts for select retailers with Amex Offers. These deals typically offer the amount you want in cashback that is which is credited to your account within 90 days following the time you have met the conditions.60,000 Rewards points for Membership Rewards(r) points when you have spent $4,000 on eligible purchases in the first 6 months following the date of AMEX Gold card account opening .

Benifits of American Express Gold Card

American Express Gold Card is a dining rewards royalty

The American Express® Gold Card is an All-Star benefit for foodies who love to eat. With the $250 annual fee, it offers cardholders access to valuable perks like 4 points per dollar spent at restaurants and U.S supermarkets (up until your first $25K), as well as a nifty dining credit worth up tp 120$ every 12 months! Becoming eligible requires signing up with good creds that can be yours once approval has been granted—but there are some terms you should know before applying: Points don’t always equate 1 cent apiece on average due .

$120 annual dining credit for American Express® Gold Card

Get this $120 in monthly credits on your account that can be applied toward purchases made with select partners. You’ll receive these rewards within two weeks of making a purchase which you don’t have to use all at once. There are a lot of benefits to using these credits. Not only will you receive ten dollars every month for as long as your account is active, but These bonus bucks also don’t roll over if you’re not using them- use it while they last .

American Express Gold Card income requirements

American Express does not specify a minimum income but it does require sufficient income to cover the costs of the card, and also to pay the annual fee of $250. Amex does not disclose the other Amex Gold Card conditions however there are a lot of other aspects that Amex examines in their approval procedures.

Shopping Reward of Amex Gold Card

The current Boxed offer says: If you spend $75 or more, and receive $20 back.

There are a variety of offers based on locations and are generally only available for a specific time. There are usually the minimum requirements for spending and the maximum benefits for earning. Additionally, offers may vary among different Amex cards as well as between cardholders.

Cardholders can enroll for a free ShopRunner membership that provides 2 days of free shipping on eligible purchases at more than 100 online retailers including Bloomingdale’s and Neiman Marcus. Learn more about the way ShopRunner operates.

If you attempt to return a purchase you made by using Your gold Card in the initial 90-day period after your purchase date but the seller isn’t willing to take it back, Amex may refund eligible items as much as $300 per item ($1,000 maximum per calendar year based upon the purchase date)

Travel benefits

The American Express Hotel Collection is a great option for travellers who want to stay at select hotels and get exclusive perks, such as $100 hotel credit. Cardholders can also receive complimentary room upgrades with their Gold Cards! There are additional travel protections like baggage insurance up to $1,250 per trip if you carry-on or check your bags on the plane – that’s more than enough protection in case something happens while traveling abroad.

The American Express Hotel Collection is a great way to get up to $100 in hotel credits after booking via American Express Travel portal two consecutive nights or more. You can also use your card for stays at 600+ eligible properties, so it’s easy!

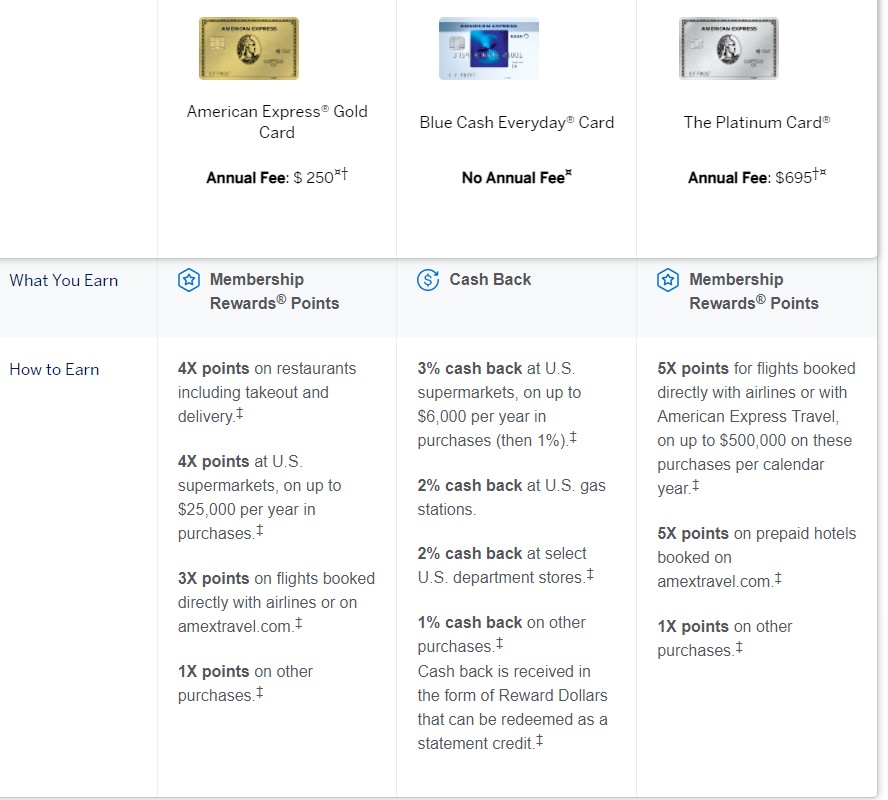

4X Membership Rewards®

Earn 4X Membership Rewards® Points at Restaurants, including takeout and delivery, and earn 4X Membership Rewards® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X). (businessinsider.com)

Cons of American Express Gold Card

There are so many different benefits to having an American Express Gold Card, but it comes at the price of some annoying drawbacks. Like how you have a $120 annual dining credit that can only be used for certain purchases or if they want too transfer points from one airline’s loyalty program into another’s there is a fee charged with this service which could range anywhere between 1% – 5%.4 pts per dollar spent at U.S supermarkets (but there’s an annual spending cap),but there’s another catch–you must spend at least $1000 within any given calendar year.

The Gold card has an annual cost of $250. Other advantages that come with other benefits of the AMEX Gold card include up to $120 worth of dining credits per year at selected dining outlets.The Gold card also provides the credit of $100 for airline fees each year, when checked baggage or meals on flights will be charged directly to your Gold Card.

The American Express Gold Card is perfect for cardholders who want to earn 4 points per dollar on practically anything you eat or drink. These benefits are offered by many other cards but the best part about it? You get them without having any annual fees!

Bonus Rewards Problem of Amex Gold Card

In the past, card holders were complaining issues with the american Express(r) Gold Card isn’t consistently crediting the card with the bonuses they’re entitled to on purchases at restaurants. The issue was discovered in restaurants that have employed third-party payment processors for example, Square and Toast. This is a problem with restaurant purchases, particularly, as many people rely on processors like those. It was not clear if the card’s rivals appeared to be affected by the same issue.

However, in June of 2019, AmEx confirmed to NerdWallet that it had changed its system to ensure that purchases made where dining is included automatically accrue bonus rewards. The company recommends that cardholders contact American Express customer service when they think they could have earned additional reward points.

-

American express gold card limit

The American Express Gold Card has no preset spending limit, which means the credit limit is determined on a month-to-month basis, depending on the cardholder’s previous spending habits, income, payment history and other factors. Amex Gold cardholders are not told what their monthly spending limit is as a result.

While no pre-set spending limit can offer you some flexibility, it can be difficult in emergency situations. You can know roughly what you’re able to spend based on past months, but you never know exactly when a future purchase will be declined. -

American express gold card requirements?

To be eligible for the American Express® Gold Card, your credit score needs to reach an average of 700 or higher. If you have good or better scores then it’s possible that approval could come quickly

-

What are the American Express Gold Card requirements for approval?

The Amex Gold Card is not an easy credit card to get, but with the right qualifications, it can be worth your time. The biggest requirement for this offer is that you have a good enough financial standing in order to make payments on time and afford $250 annual fee each year. American Express doesn’t openly state any additional requirements beyond these two points so applicants should check closely before applying! .

A credit score over 700, age 18 or older and US citizenship/residency are just some requirements! While they don’t list an income requirement on their website it’s safe assume that this card isn’t going applications from people with little financial capabilities since there is no additional information available online about what exactly Amex looks at when reviewing one’s application.

american express gold card limit

The American Express Gold Card is a great option for people who want to have some flexibility when it comes to their credit limits. Since there’s no preset spending limit, the monthly allowances depend on numerous factors including your previous history with money and income level among other things. However, this can make emergency situations difficult because you never know exactly how much of an unexpected purchase will be declined in advance!

gold american express card limit,

american express gold card benefits,

american express gold card requirements

The American Express® Gold Card is a great option for people with good or better credit.

To be eligible for the American Express® Gold Card, your credit score needs to reach an average of 700 or higher. If you have good or better scores then it’s possible that approval could come quickly .

As well as these factors impacting how likely they are: income; any existing debts such as loans from banks and stores offering student loan repayment plans which can lead them into difficulties if not paid back on time each month (you also need a certain amount plus 20%); number of open accounts within different lenders – this includes cards with outstanding balances too but make sure none has been closed recently by contacting customer service first before getting anymore applications sent over

\ If you’re approved, your card will be sent in the mail within two weeks! .

American Express® Gold Card

The American Express® Rose Gold Card

American Express® Gold Card

Annual Fee $250¤†

Customize Card Color

Rose Gold

Gold

♦‡†Offer & Benefit Terms ¤Rates & Fees

16.24% to 23.24% variable APR on eligible charges.¤

Apply Now

american express gold card review,

american express rose gold card,

american express gold card annual fee

https://bdnewsnet.com/wp-content/uploads/2021/11/american-express-gold-card-Terms-Conditions-Disclosures.pdf

American Express® Rose Gold Card Terms and condition

Apply for American Express Gold Card in official website

Refarences:

American Express Gold Card 2021 Review – Forbes Advisor

American Express Gold Card Review: Dining Rewards Royalty

- Credit card

- Amex Gold Card

- Gold Card

- Card

- American Express

- American Express Gold Card

- American Express Gold Card review

- American Express Gold Card Terms & Conditions

- American Express Gold Card Reviews

- American Express Gold Card Credit Card

- American Express Gold Cards

- American Express Gold Card Benefits

- American Express Gold Card Fees

- American Express Gold Card Application

- American Express Gold Card Approval Process

- American Express Gold Card Balance Transfer

- American Express Gold Card Cash Back

- American Express Gold Card Features

- American Express Gold Card Interest Rate

- American Express Gold Card Payment Options

- American Express Gold Card Promotions

- American Express Gold Card Rewards Program

- American Express Gold Card Requirements

- American Express Gold Card Sign Up Bonus

- American Express Gold Card Summary

- American Express Gold Card Unpaid Bill Fee

- American Express Gold Card Verification

- American Express Gold Card Visa Debit Card

- American Express Gold Credit Card

Topic Clusters

Topics referenced across search results organized in clusters:

cards

- Credit cards

The American Express Gold Card has been a staple of the credit card industry for over 50 years.The American Express credit card offers a ton of benefits. On top of the points you get for using your card, there are exclusive discounts and special offers that come with having an Amex Gold Card .

- Gold Card

The American Express Gold Card was first introduced back in 1984 as an alternative option for those who wanted more than what their typical credit card had to offer. Over the years it has grown into one of the most desired cards on the market .

- Card Members

The American Express credit card offers a ton of benefits. On top of the points you get for using your card, there are exclusive discounts and special offers that come with having an Amex Gold Card members. This is what you need to know about the perks that come with owning this high end credit card.

The American Express credit card offers many great benefits including points earned on each purchase as well as exclusive discounts and special offers only available to those who own this high end credit card

- Platinum card

- Amex Gold Card

- Green Card

- Corporate Card

- card membership

- eligible card

purchase

- purchase

- eligible purchases

- Purchase protection

- combined purchases

- dining purchases

- everyday purchases

- travel purchases

- flight purchases

- supermarket purchases

- delay insurance Purchase protection

Chase

- Chase

- Chase Ultimate Rewards

- Chase Ultimate Rewards®

- Chase Sapphire

- Chase Sapphire Reserve

- Chase Sapphire Preferred

baggage

- baggage

- baggage insurance

- Baggage insurance plan

- Baggage insurance Trip delay

- insurance Baggage insurance Trip

- carry-on baggage

airlines

- airlines

- annual airline fee credits

- airline fee credits

- airline incidental

- eligible airline

statement

- statement

- statement credits

- annual statement credits

- time of statement credit

- annual dining statement credit

Marriott

- Marriott

- Marriott Brilliant

- Marriott Brilliant Amex

- Marriott Bonvoy

- Marriott Bonvoy Brilliant™

delivery

- delivery

- delivery fee

- food delivery services

- delivery services

- food delivery

partner

- partner

- hotel partners

- transfer partners

- transfer partner options

- commerce partners

score

- score

- credit score

- Credit Score ranges

- types of credit scores

- variety of credit scores